Anyone who steps back and looks clearly and honestly at our current economy knows we’re on a slippery slope. Indicators of recovery right now are fragile and, in many cases, illusory. Unemployment numbers generally don’t account for the growing ranks of the permanently unemployed. The startling first quarter dip in GDP may have been weather-related, but even if it was, what does that say about our green shoots — it takes little more than a harsh winter to turn them brown?

Anyone who steps back and looks clearly and honestly at our current economy knows we’re on a slippery slope. Indicators of recovery right now are fragile and, in many cases, illusory. Unemployment numbers generally don’t account for the growing ranks of the permanently unemployed. The startling first quarter dip in GDP may have been weather-related, but even if it was, what does that say about our green shoots — it takes little more than a harsh winter to turn them brown?

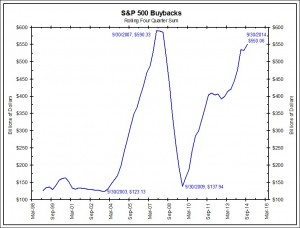

The stock market boom seems fragile as well. It depends heavily on financial engineering rather than solid growth in the underlying value of our companies. In other words, our stock prices are rising while almost everything else languishes. The Dow doesn’t reflect the stagnation of our industrial and retail markets, yet stock prices continue to rise, at least partly because companies are buying back shares of stock in record numbers. This would suggest the numbers are being artificially boosted. While stock buybacks are likely one of the biggest lynchpins of financial engineering, so are stock splits and increased dividends. Finally, the low-cost of capital and short-term yields make the market appear to be the only place to park one’s money.

As Barrons reported last year, “In the fourth quarter of 2013, S&P 500 companies may have bought back nearly $138 billion worth of stock… if that estimate proves correct as companies file their quarterly disclosures, it’ll be the biggest quarter for buybacks since 2007 and a 40% jump from the level a year ago.”

That suggests to me companies are worried about how long the latest bubble will last: the equity bubble. Take away the tampering and this boom market could easily turn bear. Why? Because our so-called recovery isn’t robust, thanks to a general economy where not enough people have enough discretionary income to spend. Gridlock in Congress has stalled efforts to pump stimulus money into infrastructure jobs, even though the nation is woefully overdue for a major reconstruction: bridges, roads, airports, you name it. Even a well-intentioned push to increase the minimum wage has languished, (though some enterprises are raising their own minimums, without a change in the law.) Our private sector needs to step up and lead, and yet too many captains of industry and commerce, along with Wall Street, obsess about short-term appreciation of stock prices — as those record buybacks testify.

Recently, a friend wrote to me about buybacks: “They look to me like part of a mad chase for yield in a zero interest-rate world. Technically, a buyback provides no yield, yet they are designed to provide immediate stock appreciation.” Which is yield in a culture of short-term shareholder value. Well and good, if stock prices were all that mattered. But stock price has become the Maltese Falcon of American business — a grail we chase and chase to keep our spirits up and convince ourselves the future can still be exceptionally good, at least for those of us who can get our hands on stock. In the end, the Maltese Falcon, though it appeared to be precious, was made of lead.

We’re squandering our future obsessing about stock price, hoping that a rising stock market will lift us all out of these doldrums. In other words, the money we’re using to pump stock prices would be better used by investing it in the underlying value of those stocks: in R&D for product innovation and higher compensation for employees (outside top managements who are generally overpaid). That’s the kind of delayed gratification we need right now: a courageous willingness to wager on the long-term future, not only what’s going to happen before this afternoon’s closing bell. If it means more money goes into more pockets of the people who are actually laboring to create new value in this country — the middle class worker — then let the stock market take a breather. If investment and innovation rise, stock prices will have plenty of time to catch up, as long as we all have the character and the nerve to believe in America’s long-term future once again.